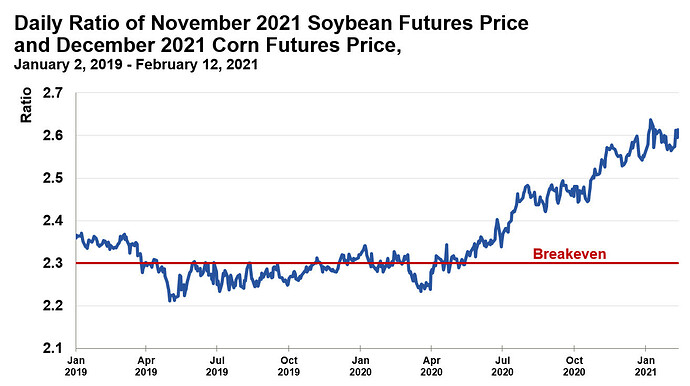

Evolution récente du ratio soja novembre 21/corn décembre 21.

Le trait rouge à 2.3 indique le ratio où les deux cultures ont une rentabilité identique.

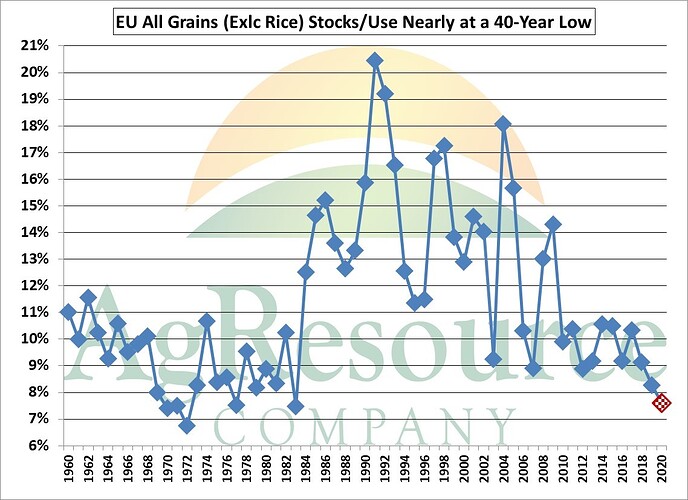

L’Union Européenne aurait un faible stock de grain en fin 20-21 avec un ratio stock/utilisation qui tomberait à son plus bas niveau (8,6%) depuis 1983.

EU grain S&D hasn’t been this tight in nearly 40 years. USDA projects stocks/use to be 8.6%, the lowest since 1983 (when it was at 7.5%). USDA’s projection has fallen 1.3 pct points in the last 4 months. EU prices are rising but have further to go.

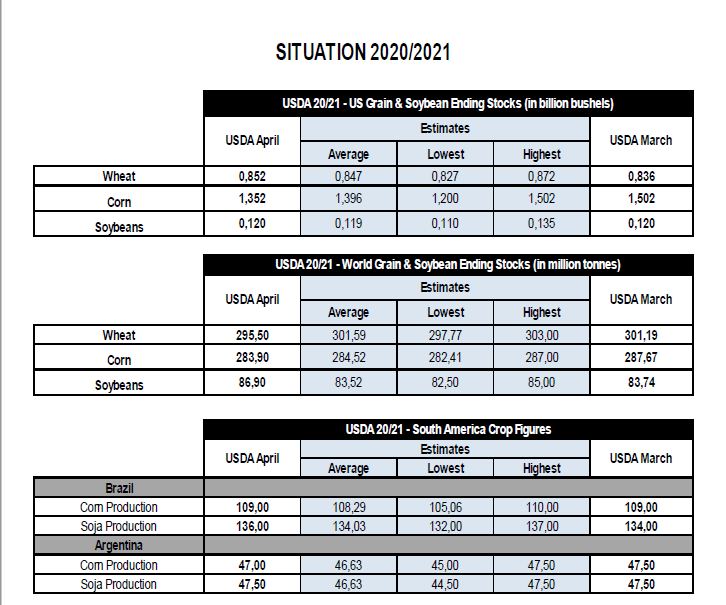

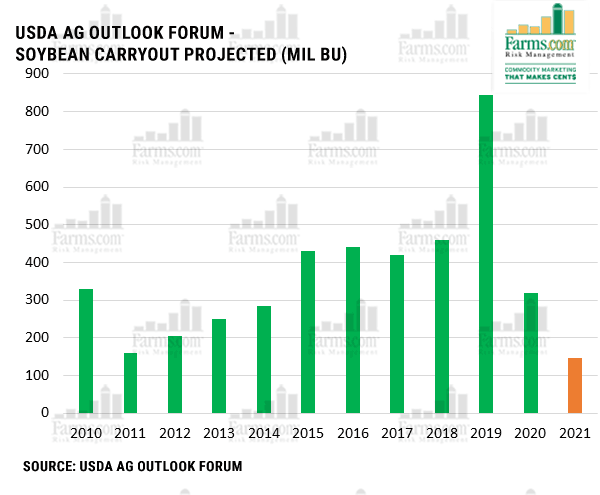

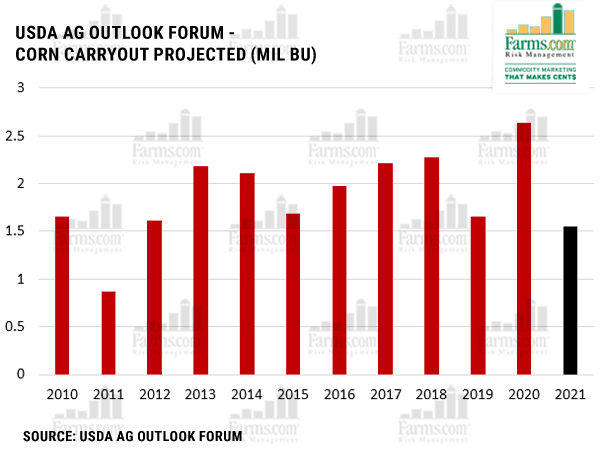

L’USDA prévoit les plus faibles stocks fin aux États-Unis depuis 2011, en soja et en maïs.

Since at least 2010, USDA has not reported US soybeans carryout this tight in the early annual Ag Outlook Forum (despite record output anticipated & second-highest yield)! corn carryout is the tightest projected since the 2011 (LaNina)

Les futures blés US montent.

Les blés d’hiver aux États-Unis ont souffert dans une des premières régions productrices, l’Ouest du Kansas, l’Est du Colorado et le Sud-Ouest du Nebraska.

Gros dégâts de gel sur blé avec des températures de -29°C jusqu’à-34°C sans neige protectrice,

Pour compléter le tableau, les sols sont plutôt secs et les prévisions long terme sont mauvaises de ce côté là pour le Texas, l’Oklahoma, le Kansas et le Nebraska.

U.S. winter wheat crop faces danger

By Sean Pratt: February 22, 2021

Historically low temperatures in Kansas, Nebraska and Colorado combined with severe dryness in those states is threatening yield potential, according to U.S. Wheat Associates.

A prolonged cold snap in the Great Plains region of the United States may have caused serious damage to the winter wheat crop.

Historically low temperatures in Kansas, Nebraska and Colorado combined with severe dryness in those states is threatening yield potential, according to U.S. Wheat Associates.

“Producers in the Great Plains have seen sustained temperatures below (-12 C), low enough to cause serious concern about the crop’s ability to survive dormancy,” USW market analyst Claire Hutchins wrote in a recent Wheat Letter blog.

Snow cover would typically help insulate the crop against freeze damage but western Kansas, western Nebraska and eastern Colorado have been exceptionally dry.

Topsoil moisture in Kansas was rated 21 percent very short and 34 percent short as of January. That is 15 percentage points worse than a year ago for those two categories combined.

Nebraska is concerned about poor emergence and weak stands. According to the U.S. Department of Agriculture, 30 percent of the state’s crop is rated good to excellent, compared to 70 percent a year ago.

Some analysts are shrugging off the cold snap, noting that the U.S. winter wheat crop has recovered from similar events in the past.

But USW appears to be concerned.

“Unlike lighter freeze damage, from which the wheat can bounce back under the right conditions, this year’s freeze event has the potential for winterkill in some regions and ultimately challenge the final production volume,” said Hutchins.

Arlan Suderman, chief commodities economist with StoneX, shares her concern. He noted that the thermometer dropped to -29 to -34 C in portions of the central Plains on Valentine’s Day.

He said in a recent tweet that Commodity Weather Group estimates 30 percent of the hard red winter wheat crop was susceptible to significant damage and another 15 percent to spotty damage due to lack of snow cover.

“Wheat is a funny plant that does the unexpected but as a former agronomist, this was about as extreme as I’ve seen it in Kansas over the past 40 years,” Suderman tweeted.

“I know that wheat will make a liar out of anyone, doing what it’s not supposed to do. But conditions were harsh enough to do considerable damage this weekend.”

Wheat growers in Nebraska and Colorado told USW that early spring rain will be the key to determining this year’s production potential.

“If we go too long into the growing season without moisture we will start losing potential,” said Brad Erker, executive director of the Colorado Association of Wheat Growers.

“We are in worse shape now than this time last year and 2020 ended up being a very small crop for us. We can’t wait until the end of April for moisture or we will lose a lot of acres.”

The U.S. National Oceanic and Atmospheric Administration is forecasting either persisting or developing drought for Texas, Oklahoma, Kansas and Nebraska this spring through the end of May.

Meanwhile, SovEcon is reporting that Russia’s wheat crop entered winter in the worst condition in a decade and poor snow cover has left some areas vulnerable to winterkill.

The consultancy recently scaled back its 2021-22 Russia wheat production forecast to 76.2 million tonnes, down from its prior estimate of 77.7 million tonnes.

That would be well below the 85.9 million tonnes produced in 2020-21.

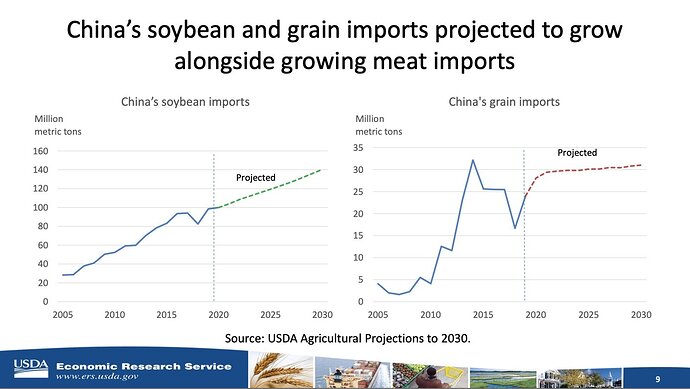

La Chine achète d’énormes quantités de matières premières agricoles (MPA).

Pour bien appréhender ce qu’est la Chine, il faut savoir que la Chine, c’est 1 milliard 440 millions d’habitants soit autant que;

États-Unis + Canada + Amérique du Sud + Europe (sans la Russie) + Australie + Nouvelle Zélande

Et les chinois évoluent et le temps où ils se contentaient (pour carricaturer) de manger du riz est révolu; maintenant, ils mangent aussi de la viande et pour la produire, il faut nourrir les animaux et les besoins de produits végétaux sont immenses, donc ils importent.

La hausse du prix de nos MPA va relancer une nouvelle fois le débat sur la hausse des prix alimentaires dans le monde.

Le prix départ ferme de la matière première brut que nous produisons ne représente que 20 %( à la louche ) du prix du produit final acheté par le consommateur. Les 80 % restant du prix représente du transport, de la transformation, des frais de commercialisation etc. Cela veut dire que le prix final des produits alimentaires sont beaucoup plus impactés par le prix de l’énergie ou de la main-d’œuvre par exemple… Le prix départ ferme peut varier énormément et ne pas avoir un impact aussi significatif pour le consommateur.

Quand nos prix de ventes augmentent, il y a certes une certaine répercussion sur le prix final du produit, mais c’est une erreur de projeter cette augmentation directement sur le prix payé par le consommateur.

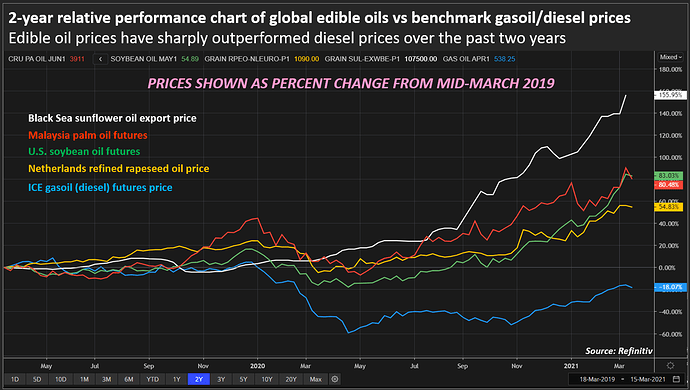

Performance des huiles végetales vs gasoil européen depuis deux ans:

Blanc : huile de tournesol mer noire

Rouge : future huile de palme Malaisie

Vert : future huile de soja U.S.

Jaune : huile de colza raffinée départ Hollande

Bleu : future avril 21 gasoil européen - LFJ21

L’utilisation des huiles végétales comme carburant avec en comparaison un prix de l’energie fossile à la traine commence à faire polémique car ces huiles végétales sont aussi un produit alimentaire de première nécessité dans le monde entier et le renchérissement de leur prix à un impact direct sur le budget des populations les plus défavorisés.

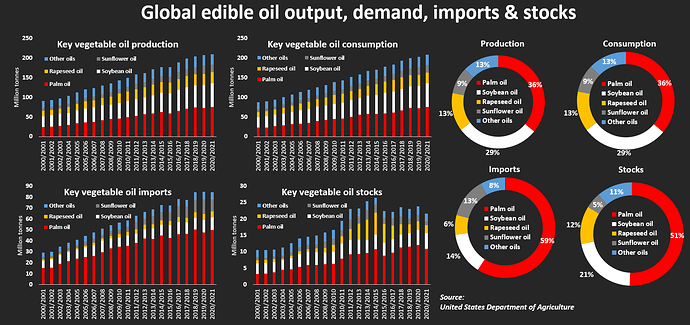

Huiles végétales dans le monde sur 20 ans

Production - Consommation - Importations - Stocks

jaune : colza

rouge : palme

blanc : soja

gris : tournesol

bleu : autres.

Construction de porcheries à plusieurs etages - jusqu’à 12 - en Chine :

Le 30 Mars rapport USDA trimestriel.

En fait on n’en a pas grand chose à faire car si on attendait après les rapports US pour gagner de l’argent, le résultat serait vraiment faiblard au 31/12.

Ce sont des dates pour rester prudent à ce moment.

Mais guère plus au final.

La prudence reste l’élément majeur à retenir d’un rapport USDA.

Et le plus souvent rester hors marché le temps de son passage.

Au tout début de VSB, Toto, l’original !, nous expliquait souvent passer off en futures avant le rapport.

Ou des décisions clairement réfléchies et assumées, en toute connaissance et prévision du risque de volatilité.

(manque de temps en ce moment mais:)

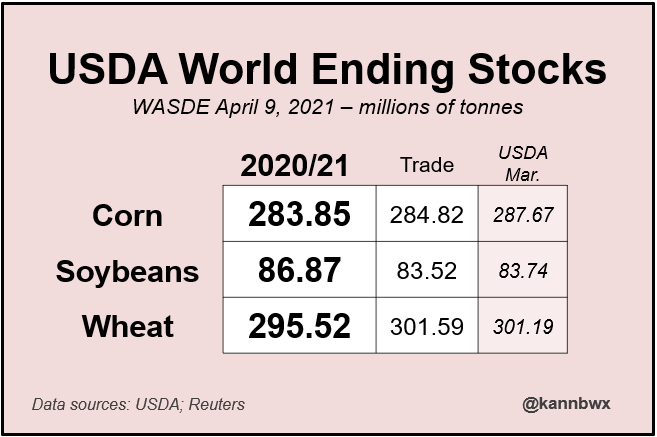

Un petit mot sur VSB suite au WASDE de ce soir:

en MMt

stocks fin blé 20-21

mondial en baisse de 5.67

sans Chine, baisse de 0.67

légère hausse aux USA +0.42

4 principaux exportateurs -0.14 (dont Russie -0.5)

6 principaux importateurs -5.64 (dont Chine -5)

maïs

stocks fin en MMt

monde -3.82 (dont Chine inchangé!)

mon avis: blé pas baissier et même plutôt un peu haussier mais il faut attendre que les « pros » aient le temps de faire leurs soustractions et ils sont parfois longs à la détente car le soir du WASDE, les réactions sont épidermiques et beaucoup gèrent leurs positions sans plus.

Maïs idem.

Voilà pour le WASDE avril 2021 (désolé, je n’ai pas le temps pour les oléagineux)

En ce moment, tout le monde regarde la météo: trop sec, trop froid, épis gelés ou pas? Des colzas ont subis de pertes ou pas?

Je ne pense pas qu’il y aura des dégats en blé orge et colza, et meme s’il y en aura dans certains secteurs, ce sera très minime…

Si dégat en colza, ce sont déjà des colzas « à la ramasse » avec les altises…

Pour ma part, en Picardie, aucun dégat.

La logique économique voudrait que les surfaces US implantées en 2021 augmentent beaucoup car les prix ont beaucoup augmenté. Mais le dernier rapport USDA indique que ce ne serait pas le cas. Depuis aout 2020 les prix du blé, soja et corn ont augmenté de 35 % avec comme moteur principal la demande chinoise.

Avec de telles augmentations de prix quelles devraient être l’augmentation des surfaces emblavées ? En moyenne les surfaces augmentent de 0.3% pour une augmentation du prix de 1%. Avec 35% de hausse on aurait dû voir les surfaces augmenter de 10.5 %. En 2020 les farmers ont ensemencés 218 millions d’acres de blé, soja et corn. On aurait donc dû avoir 23 millions d’acres en plus. Au lieu de cela , l’ USDA n’a trouvé que 7 millions de plus : 5 millions en soja, 2 millions en blé et rien pour le corn.

Cela a surpris les marchés et le soja et le corn ont pris 6% le jour du rapport et le blé 3%. Ces hausses indiquent que le marché estime que l’offre ne répond pas à la demande. Des hausses de 3 et 6 % sont très faibles par rapport aux nombres d’hectares qui manquent.

Une explication est que l’USDA s’est trompé, mais c’est assez rare que cette administration se trompe aussi grossièrement.

Les farmers ont mal répondu.

L’augmentation des couts de production : engrais + 20 à 30 %, pétrole + 50% depuis novembre.

Ces explications ne sont pas suffisantes et beaucoup s’attendent à voir les surfaces en soja et corn augmenter dans le rapport du 30/06/21.

Tout a fait d’accord on peut laisser monter les cours personne n’achète en mai juin et de très gros ensemencement en juin renverront les cours Une stratégie bien connue de L’Usda.Des gros titres dans les journaux canadiens L’usda s’est pris les pieds dans le tapis. L’article parle de 10 millions d’acres en trop en mais pas régularisé pendant un an .6 pour cent de production en trop sur 380 millions de tonnes pas de sttock donnée un export prévu Chinois de 7 millions de tonnes qui finit à 24 millions de tonnes .Toutes ces erreurs font hurler les agriculteurs ,la ils ont mis le curseur inverse en sous estimant les surfaces pour les exploser au 30 juin .

L’augmentation des surfaces de 0.3 % pour une augmentation du prix de 1 % ne se vérifie que lorsque les trois productions principales que sont le blé, le soja et le corn augmentent simultanément ce qui est le cas en 2021. Autrement, il y a compensation par une répartition différente de l’assolement.

L’USDA a estimé des stocks fin (20-21) inférieurs aux chiffres attendus par le marché (c’est à dire inférieurs à la moyenne de ce qu’attendaient les grands analystes, grands opérateurs…) En blé et en maïs.

C’est plutôt haussier, mais…?